Then, convert the proceeds into the total number of shares that the holders would have purchased, using the average market price during the reporting period. If there are any dilutive options and warrants, assume that they are exercised at their exercise price. Similarly, convertible debt is considered anti-dilutive when the interest expense on any converted shares exceeds basic earnings per share. You should consider convertible preferred stock to be anti-dilutive when the dividend on any converted shares is greater than basic earnings per share. If there are convertible instruments outstanding, include their dilutive effect if they dilute earnings per share. The presumption of settlement in stock can be overcome if there is a reasonable basis for expecting that settlement will be partially or entirely in cash.Įffects of convertible instruments. If there is an open contract that could be settled in common stock or cash, assume that it will be settled in common stock, but only if the effect is dilutive. When you calculate the number of potential shares that could be issued, do so using the most advantageous conversion rate from the perspective of the person or entity holding the security to be converted. In addition to the issues just noted, here are a number of additional situations that could impact the calculation of diluted earnings per share: If a conversion option lapses during the reporting period for dilutive convertible securities, or if the related debt is extinguished during the reporting period, the effect of these securities should still be included in the denominator of the diluted earnings per share calculation for the period during which they were outstanding. Unless there is more specific information available, assume that these shares are issued at the beginning of the reporting period.ĭilutive securities termination. If there is potential dilutive common stock, add all of it to the denominator of the diluted earnings per share calculation. This situation arises when a business experiences a loss, because including the dilutive shares in the calculation would reduce the loss per share.ĭilutive shares. If there are any contingent stock issuances that would have an anti-dilutive impact on earnings per share, do not include them in the calculation. You may need to make additional adjustments to the denominator of this calculation. Adjust for the after-tax impact of dividends or other types of dilutive potential common shares. The conversion would eliminate the company’s liability for the interest expense.ĭividends. Eliminate any interest expense associated with dilutive potential common stock, since it is assumed that these shares are converted to common stock. You may need to make two adjustments to the numerator of this calculation. (Weighted average number of common shares outstanding during the period + After-tax interest on convertible debt + Convertible preferred dividends)) ÷ ((Profit or loss attributable to common equity holders of parent company This dilution may affect the profit or loss in the numerator of the dilutive earnings per share calculation.

This means that you increase the number of shares outstanding by the weighted average number of additional common shares that would have been outstanding if the company had converted all dilutive potential common stock to common stock.

To calculate diluted earnings per share, include the effects of all dilutive potential common shares.

#How to calculate earning per share on sale of common stock how to#

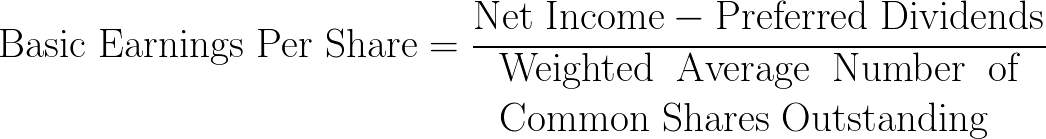

How to Calculate Diluted Earnings per Share This information is reported on the company’s income statement. If a company has more types of stock than common stock in its capital structure, it must present both basic earnings per share and diluted earnings per share information this presentation must be for both income from continuing operations and net income. Earnings per share information only needs to be reported by publicly-held businesses. Thus, this measurement presents the worst case for earnings per share. The reason for stating diluted earnings per share is so that investors can determine how the earnings per share attributable to them could be reduced if a variety of convertible instruments were to be converted to stock. What is the Diluted Earnings per Share Formula?ĭiluted earnings per share is the profit per share of common stock outstanding, assuming that all convertible securities were converted to common stock.

0 kommentar(er)

0 kommentar(er)